Florida has long held the reputation as the retirement capital of U.S. – but, not all 55+ communities are the same. It’s not just about home size, location, amenities, or the color of the walls. When you are looking to relocate to Florida, the active adult community you choose has to have the right balance: one that feels like home, and one that provides comfortable and safe environment to embrace your retirement years. This is where a like Realtor Lorraine Valdes can help.

Lorraine Valdes specializes in the Orlando, FL and Kissimmee, FL areas, so she can help you navigate through the many types of 55+ + “active adult” communities, and help you find exactly what you’re looking for. Communities like Solvita, Bella Lago, Bella Pointe, Champions Gate, Reunion, and Waterview are some of the most popular locations. For those who are not familiar with the Florida area, however, Lorraine is your perfect resource to help you find the ideal winter getaway, or get you established in a permanent residence. Either way, it’s important to note that Lorraine cares about her clients. She will walk you through the entire process, so buying a home becomes an uncomplicated, exciting escapade, rather than a stress-filled experience.

If you are looking for the premier community in Central Florida, the one who has received the most accolades is Solvita. Whether your preferences lie in outdoor activities like hiking, boating, bocce, tennis, or golf, or whether you are interested in yoga, clubs, chess or Zumba, there are so many pursuits to occupy your time, you may find your interests develop in so many new hobbies, that you find you’re busier in your retirement than you ever were before. The best part, however, is that they have affordable homes for people at every price point, with resale homes available in the ranges of $90,000 to $475,000, and long term rentals beginning at around $900 per month.

Tuscan-inspired, the ambience Solvita projects is reason enough to settle in, but it offers so much more. Complete with twin 18-hole championship golf courses, breathtaking wooded preserves, and spectacular sparkling lakes, its 4,300 acres offers everything you would expect in a Mediterranean village, including charming old-world streets, fully appointed clubhouses and a number of distinctive gathering spots to enhance the community’s charm. The exceptional planning and amenities available are some of the many reasons Lorraine has become the go-to Realtor of choice when it comes to Solvita real estate properties, and she can help you find your dream home, too.

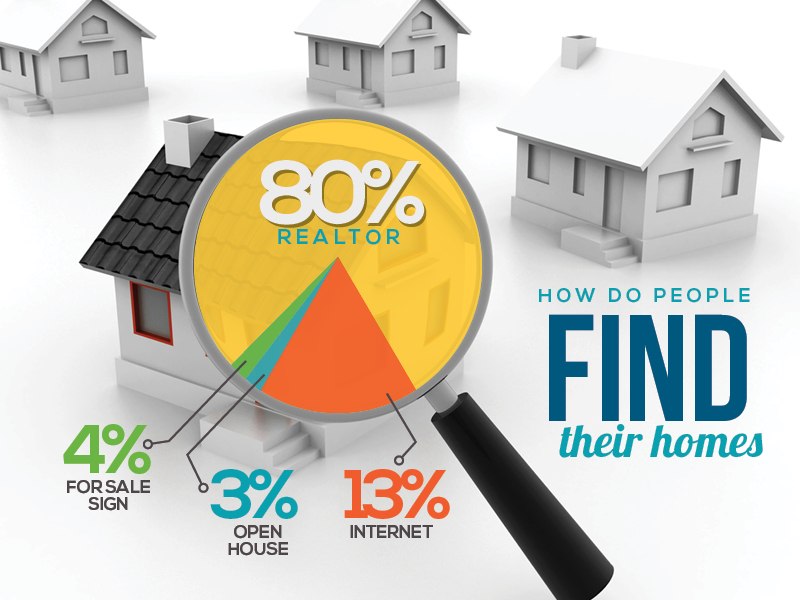

Though it’s possible to find a home on your own — whether new construction or otherwise – tackling the job on your own can become a painstaking process. This is why having the right Realtor is essential, and it is particularly important for older couples who are either retired or close to retirement, as it is a major factor in finding the right property. But, how do you know who the “right” Realtor is for you?

The right Realtor to handle your real estate needs is easy to recognize when you know what you’re looking for, and Lorraine Valdes possesses every quality and element that a good Realtor should hold. She provides not just the exceptional knowledge and service you deserve, but her attention to detail and her ability to connect with her clients make her hands-down one of the top agents in all of the Kissimmee and Orlando areas. As your real estate professional, Lorraine knows the communities that support an active adult lifestyle like the back of her hand, but she also has spent years representing buyers and sellers of all types of property as well. This means that she understands that all her clients are different, and that whether you’re looking for your first home or your last, her vast real estate expertise makes her shine.

Given that she specializes in 55+ adult communities, whether you’re on the brink of retirement, or even if you’re already there, you should consider having realtor Lorraine Valdes assist you. Her website features an abundance of information to assist buyers and sellers of all kinds, it allows you to search the MLS for new listings, and you can even visit her blog for a free buyer’s guide. Lorraine Valdes takes the challenge out of buying a home, and turns it into an exciting adventure. Your own personal paradise is waiting, and she can help you find it.